Over 200 individuals from conservation organisations, governments, companies and financial institutions have joined in a “Call to Action” for greater efforts to secure “Biodiversity Net Gain” in the context of development. The call to action was issued during Natural Capital Week, where the Business and Biodiversity Offsets Programme (BBOP) launched a new set of roadmaps and guidance for business and government to craft economic development strategies that result in an overall gain of biodiversity, rather than loss.

View the online press release here and the Call To Action here.

CPIC Releases New Blueprints to Boost Investment in Nature Conservation

A major coalition of finance and conservation organizations launched a series of blueprints aimed at replicating and expanding successful investment in nature.

The blueprints published by the Coalition for Private Investment in Conservation (CPIC) will help accelerate the development of investment deals in four sectors: sustainable cocoa, conservation forestry, marine protected areas, and green infrastructure for coastal resilience and for watershed protection.

Each blueprint is based on the experience of CPIC’s 64 member organizations, including conservation agencies, civil society bodies, financial intermediaries and banks, in launching existing deals.

For more information please see the full press release here.

Pacific Ocean Finance Program Funding Opportunity

This is an advertisement for the Request for Expressions of Interest for the Development and Coordination of the Pacific Ocean Finance Fellowship. Requests for Expressions of Interest may be downloaded from the program website.

Expressions of interest are due February 1st by 4pm Solomon Islands time.

The REOI brochure is available here for download.

IUCN - Incubator for Nature Conservation (INC) Consultancy/Internship in Conservation Finance - Peru

The International Union for the Conservation of Nature (IUCN) is seeking candidates for a paid conservation finance internship with CIMA, a Peruvian NGO (http://www.cima.org.pe/en). The finance specialist will work from the CIMA office in Lima, Peru, and help to develop an internal business development, capitalization, and financial management plan, with a specific focus on building long term financial capacity for the management of the Cordillera Azul National Park (http://www.cima.org.pe/en/cordillera-azul-national-park). The finance specialist will also visit the CIMA field headquarters near the park, and receive backstopping and technical support provided by a U.S. based specialist working with the IUCN Conservation Finance Incubator (INC) (https://www.iucn.org/theme/environmental-law/our-work/protected-areas-pa/incubator-nature-conservation). The finance specialist will work directly with the CIMA team for a period of six months starting in Feburary 2019, with a fixed stipend of U.S. $12,000 paid for all services provided. A detailed Terms of Reference with requirements and formal application procedures for this work can be obtained by sending a concise note to jtolisano@gmail.com. Applications for this position must be delivered to Justine.Brossard@iucn.org, with a closing date of January 25, 2019. An ability to read, write, and converse confidently in Spanish will be essential.

Biodiversity Finance Online Open Course

Do you need to make a stronger business case for biodiversity conservation? Do you want to become more skilled at developing financially sound and politically feasible solutions to conservation and development challenges? Do you need to know how to develop an effective biodiversity finance plan? Do you want access to more tools to assess the policy, institutional, and economic context for biodiversity finance, and to conduct a financial needs assessment to achieve a country’s biodiversity goals?

BIOFIN is offering a FREE seven-week Massive Open Online Course (MOOC) called Biodiversity Finance. It will be facilitated in English, French, Spanish and Russian, and will run from 15 April to 31 May 2019. The course is aimed at conservation planning and biodiversity finance practitioners and policymakers, but is open to everyone.

View the full invitation here, or click here to register.

CTIS Webinar Recap

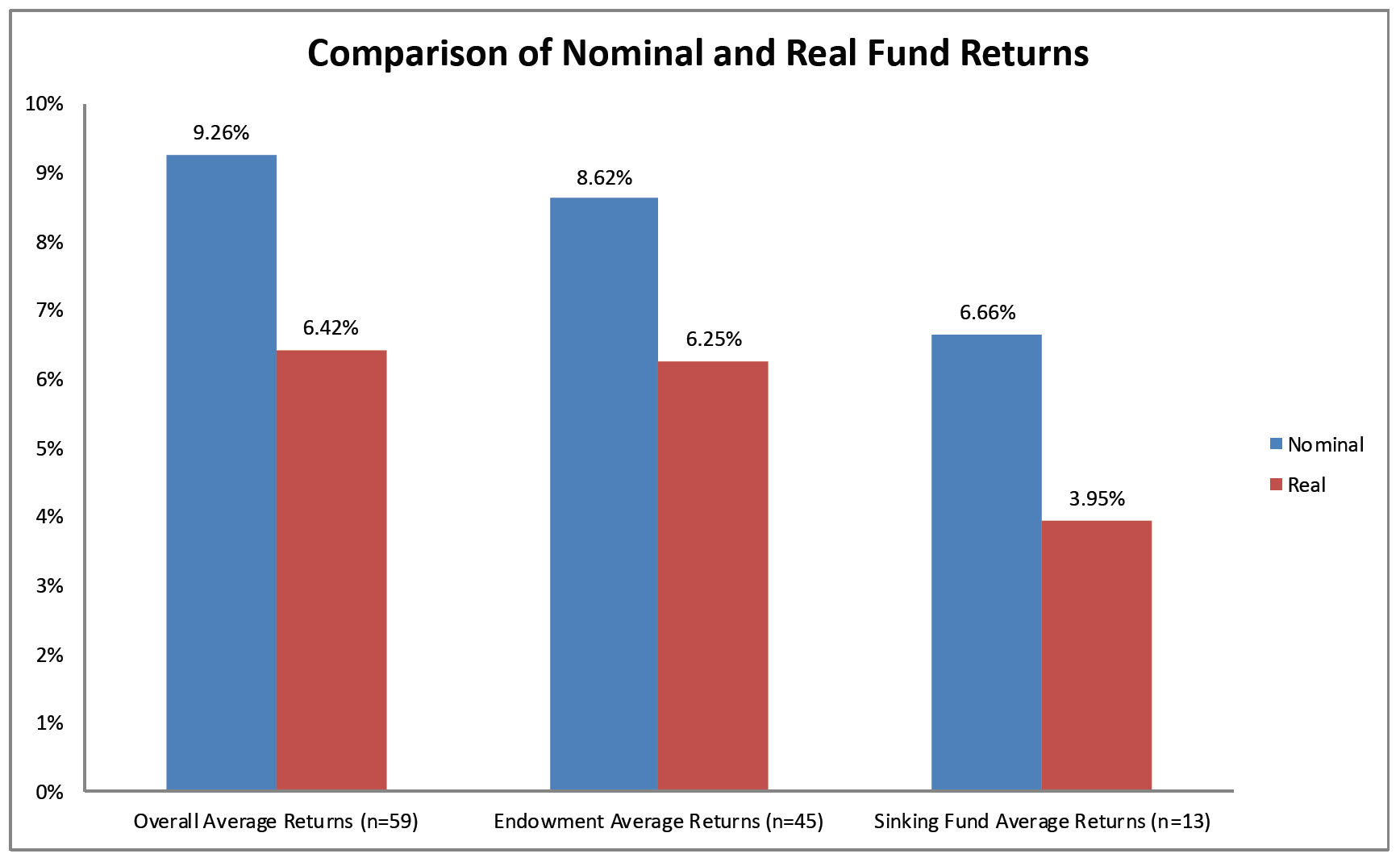

Katy Mathias, manager of the Conservation Trust Investment Survey (CTIS) Project and co-author, with Ray Victurine, of the CTIS annual report, conducted two webinars for CFA members on December 18 to share results of the CTIS report for Calendar Year 2017. The presentations were held 12 hours apart to accommodate a range of time zones. A webinar audio recording and Powerpoint slides, as well as a link to the 2017 report, are available on the CFA website.

The webinar highlighted key findings from the most recent study. The participants' organizational and endowment nominal investment returns for calendar year 2017 were higher than those from 2016, while sinking fund returns were slightly below 2016. In general, however, CTF returns were lower than might be expected given global investment performance in 2017. This may be attributed to, on average, the CTFs' tendency to under-allocate equity, relative to fixed income and cash.

USAID provides USD 37.5m guarantee to Food Securities Fund

Clarmondial is pleased to confirm that the United States Agency for International Development (USAID), through the Bureau for Food Security (BFS) and the Development Credit Authority (DCA), will support the Food Securities Fund with a USD 37.5 million credit guarantee. The agreement covers a portfolio of up to USD 150 million.

After extensive due diligence, USAID approved significant support to the implementation of the Food Securities Fund. In addition to its investment objectives and strategy, the Fund was selected based on its alignment with USAID’s impact priorities, in particular on sustainable agriculture and food security in Feed the Future countries. USAID and Clarmondial are planning an invitation-only signing ceremony with key partners in Washington DC this November.

The Food Securities Fund combines an innovative investment strategy with a standard and liquid fixed-income fund structure in Luxembourg to deliver change at scale. The Fund addresses the gap in season-long loans for agriculture production in emerging markets, thereby contributing to the UN Sustainable Development Goals – notably SDGs 1, 2, 8, 12, 13 and 15 – by promoting climate smart agriculture and responsible, deforestation-free supply chains.

The fund offers investors access to growth markets. The use of blended finance significantly reduces risk, while partnerships with leading international companies grant access to an extensive pipeline at low transaction costs.

The Food Securities Fund is supported by the blended finance platform Convergence (announcement available here). It has also received support from Climate-KIC, as well as from leading companies in the agricultural sector.

M2PA Launches Request for Proposals

The Mediterranean Marine Protected Areas program (M2PA) launched a request for proposals (RFP) for a study on Mediterranean marine protected areas financial needs assessment and management effectiveness monitoring. This RFP is funded by the GEF as part of M2PA’s project “Long term financial mechanism to enhance Mediterranean MPA management effectiveness.” The results will inform, among others, the capitalization targets and the financial structure of the environmental fund and will be used to monitor the impact on the grants awarded to MPAs.

The deadline for receiving proposals is November 16th 2018. The request for proposals and terms of reference are available for download in French and English. Please share this request with your professional networks.

Conservation International is Seeking a Full-Time Project Manager for an Innovative “pay for success” Project to Engage Hydropower Companies to Pay for Cloud Forests Conservation

Conservation International (CI) and The Nature Conservancy (TNC) are collaborating as the proponents of The Cloud Forest Blue Energy Mechanism (CFBEM). CFBEM aims to mobilize commercial finance to reforest and conserve cloud forests in Latin America that provide crucial benefits to the hydropower industry. CFBEM will employ “pay for success” contracts in which a hydropower plant pays for measurable ecosystem benefits provided by cloud forests within the plant’s catchment – principally reduced sedimentation and improved water regulation. Please see background video here.

CFBEM aims to develop pilot projects in three different locations over a nineteen month period. Three key phases until anticipated financial closure of the pilot projects, will consist of (1) site selection, (2) business case development, including ROI analysis, and (3) pilot structuring / negotiation of transactions.

CI is seeking a Spanish speaking Project Manager for a senior position based at CI’s office in Bogotá, Colombia. The PM’s role is to ensure the overall success for the CFBEM project through to financial closure.

To view the full job description in Spanish, please see the description on CI's website. The ToR is also available for download.

All application materials must be submitted before November 2, 2018 at 5pm.

IUCN - Incubator for Nature Conservation (INC) Consultancy/Internship

The International Union for the Conservation of Nature (IUCN) is seeking candidates with interest in financing nature conservation for a paid internship with CIMA, a Peruvian NGO (http://www.cima.org.pe/en). The specialist will work from the CIMA office in Lima, Peru, and help to develop an internal business development, capitalization, and financial management plan, with a specific focus on building long term financial capacity for the management of the Cordillera Azul National Park. The specialist will also visit the CIMA field headquarters near the park, and receive backstopping and technical support provided by a U.S. based specialist working with the IUCN Conservation Finance Incubator (INC). The specialist will work directly with the CIMA team for a period of six months starting in January 2019, with the contract potentially renewable for another six months, with a fixed stipend of U.S.$12,000 for each 6-month period. An ability to read, write, and converse confidently in Spanish will be essential. A detailed Terms of Reference with requirements and formal application procedures for this work can be obtained by sending a concise note to jtolisano@gmail.com. Applications for this position must be delivered to Justine.Brossard@iucn.org, with a closing date of November 23, 2018.